Most Popular Live Games of 2025: Hourly Stats & Daily Engagement Trends

The live casino sector is expected to continue solidifying its position as a dominant force within the iGaming industry in 2025. Fueled by players’ increasing demand for immersive and authentic gaming experiences, live games have evolved into a primary driver of engagement and revenue for operators and affiliates alike. Understanding not just the games players choose but also when and how they engage is critical for maximizing impact.

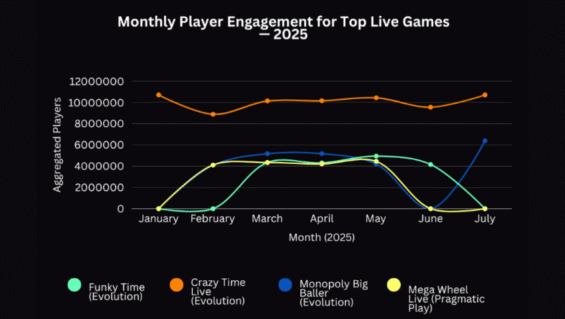

This report presents an in-depth analysis of live game popularity based on iGaming Tracker data, focusing on aggregated player counts, average hourly engagement, and daily session trends. By highlighting top-performing titles such as Crazy Time Live, Monopoly Big Baller, Funky Time, and Mega Wheel Live, we reveal nuanced patterns of player behavior that inform strategic decision-making in this competitive space.

Key Metrics: Defining Hourly and Daily Engagement

To capture the full scope of player interaction with live games, we focus on two principal metrics:

- Average Hourly Players: This represents the mean number of players active during each hour. Simply put, it shows how many players are online at any given time, helping identify the busiest hours.

- Average Daily Players: Calculated as the sum of hourly averages over a day, this metric reflects sustained engagement and player retention on a daily basis.

Combined, these metrics paint a comprehensive picture, enabling operators to optimize scheduling, promotions, and content delivery for maximum player impact.

See the chart below: Average Hourly Players by Game (Last Month), highlighting how engagement varies across titles during critical hours. This chart clearly shows peak playing times vary by game, with Crazy Time Live dominating evening engagement.

Top Live Games by Aggregated Player Counts

The competitive live casino market in 2025 is shaped heavily by a select group of games that consistently attract and retain millions of players worldwide. Based on our data, Crazy Time Live from Evolution Gaming emerges as the dominant force, maintaining monthly aggregated player counts exceeding 10 million during several peak months, such as January and May. This remarkable player volume is a testament to the game’s successful blend of engaging bonus features, real-time interactivity, and Evolution’s wide-reaching distribution network.

Crazy Time Live

Its appeal lies in dynamic multipliers, bonus rounds, and accessibility across multiple platforms, especially mobile devices. This multi-channel availability is crucial in mobile-first markets, such as Africa and Asia. The game’s innovative gamification elements, including engaging hosts and live chat, further boost player retention and session duration.

Monopoly Big Baller

Closely trailing Crazy Time Live, this Evolution Gaming product draws 4 to 5 million monthly players and shows impressive growth in 2025. Leveraging the globally recognizable Monopoly brand, it blends classic Monopoly mechanics with live game show excitement, appealing to both casual and moderately experienced players.

Funky Time

Also by Evolution, this title maintains a steady audience of 4 to 5 million players monthly. Its vibrant aesthetics and fast-paced gameplay attract younger players and those seeking energetic live experiences. Consistent promotional efforts and supplier innovation support its loyal community.

Mega Wheel Live

Pragmatic Play’s flagship game rounds out the top tier with 4 to 4.5 million monthly players. Its success reflects Pragmatic Play’s aggressive expansion and innovative live formats. Stable engagement highlights the competitive landscape as Pragmatic Play challenges Evolution by focusing on quality and a diverse range of games.

Monthly trends reveal player dynamics. For instance, Crazy Time Live experienced a 9.2% month-on-month decline in June, while Monopoly Big Baller exhibited steadier growth. These shifts may stem from seasonal behaviors, new title releases, or marketing campaigns, emphasizing the need for operators to stay agile in promotions and scheduling.

Refer to the chart below: Aggregated Players Over Time (2025) for a detailed visualization of these player count fluctuations across the top games. Notice the month-to-month shifts, such as Crazy Time Live’s June dip, underscoring the importance of agile promotion.

This analysis highlights the crucial role of game innovation, brand recognition, and supplier reach in maintaining player engagement in an increasingly competitive live casino market. Operators prioritizing these top-performing titles in their live game portfolios are well-positioned to maximize player acquisition and retention effectively.

Hourly Engagement Trends: Pinpointing Peak Activity

Analyzing hourly player engagement reveals critical patterns that influence how operators schedule live games and target promotions. Across key markets in 2025, peak playing times for live games consistently fall between 7 PM and 10 PM UTC, aligning with prime leisure hours in major regions such as Europe and North America. These windows represent moments when players are most likely to engage deeply with live dealer content, utilizing interactive features and bonus rounds.

Crazy Time Live exemplifies this trend, with its average hourly player count peaking during these evening hours. This peak reflects both the game’s global popularity and its ability to capture attention during times when players are most available. The intensity of engagement often leads to longer session durations and higher betting volumes, which in turn impact operator revenues and the workload of live dealers.

The Monopoly Big Baller and Funky Time titles share similar, but slightly more varied, hourly patterns. While they experience increased engagement in the evening, their peaks sometimes extend into late-night hours, especially in regions with differing time zones or player habits. This variation highlights the importance of nuanced scheduling strategies tailored to specific markets.

Operators leveraging these insights can optimize live dealer staffing to meet demand efficiently, ensuring seamless gameplay and reducing downtime. Aligning promotional campaigns with peak periods maximizes reach and player responsiveness, leading to higher conversion rates and longer retention.

The first chart: The Hourly Player Activity Heatmap, vividly illustrates these hourly engagement trends, displaying player density across hours and games. The heatmap confirms peak hours and highlights differences across regions and titles.

Understanding and responding to these temporal patterns is crucial to developing a competitive strategy in live gaming. Operators who anticipate player behavior with precision gain significant advantages in loyalty and revenue.

Daily Engagement Patterns and Loyalty Insights

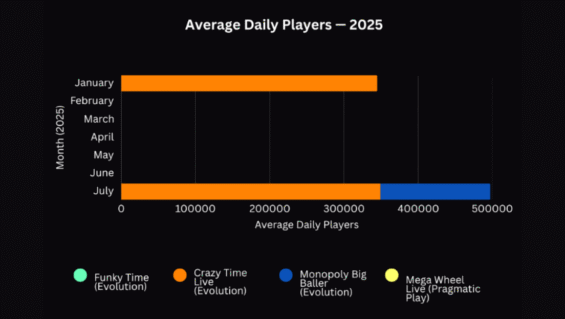

While hourly metrics provide snapshots of player activity, daily engagement offers broader insight into retention and loyalty. Titles like Crazy Time Live consistently register high average daily player counts throughout 2025, demonstrating sustained appeal across multiple segments.

Key patterns:

- Weekend spikes: Live games experience a 15-20% increase in daily players from Friday through Sunday, often attributed to bonus events, tournaments, and exclusive content designed to re-engage existing players and attract new ones.

- Episodic spikes: Some games show sudden peaks tied to marketing pushes or game updates, such as limited-time bonus rounds or seasonal events. While beneficial in the short term, sustained daily engagement remains the more reliable indicator of long-term success.

The below chart, Daily Player Trends, compares these patterns, distinguishing steady performers from games with volatile spikes related to promotions or events.

These insights underscore the importance of employing layered engagement strategies, which involve steady content updates and consistent promotions, complemented by targeted high-impact events to create a sense of urgency and excitement.

Regional and Supplier Dynamics

The global live gaming market in 2025 exhibits significant regional variation, driven by cultural, regulatory, and technological factors. Evolution Gaming continues to dominate with flagship titles like Crazy Time Live and Monopoly Big Baller, commanding major shares across Europe, North America, and emerging markets.

Pragmatic Play’s Mega Wheel Live promotes supplier diversity, appealing particularly in mobile-centric regions such as Africa and Asia.

Beyond these leaders, emerging suppliers like Authentic Gaming and Playtech are gaining traction by introducing niche live games and integrating cutting-edge technologies such as virtual reality (VR) and artificial intelligence (AI). Staying informed about these newcomers and trends helps operators maintain a competitive edge.

Regional peak hours vary: European and North American players tend to favor evening to late-night play. At the same time, Asian markets have more dispersed activity, aligned with local habits and mobile gaming trends. These nuances underscore the importance of regional customization in scheduling and marketing.

Operators that combine supplier strengths with regional preferences are better positioned to capture diverse player segments, thereby maximizing market share and lifetime player value.

Strategic Takeaways for Operators and Affiliates

The data analysis offers clear strategic directions:

- Schedule live dealer shifts to coincide with identified peak hours, ensuring optimal player experience and operational efficiency.

- Align promotions with these peak periods to drive greater player response and revenue uplift.

- Prioritize top-performing live games with proven engagement metrics for marketing and lobby placement.

- Continuously monitor monthly engagement trends to identify shifts and proactively adapt offerings.

- Affiliates should leverage hourly and daily engagement insights to optimize content timing, SEO keywords, and targeted campaigns, maximizing conversion potential.

These data-driven strategies empower stakeholders to respond quickly and effectively to a dynamic market, fostering sustained growth and competitive differentiation.

Conclusion: Navigating Live Game Success in 2025

Live casino gaming’s momentum shows no sign of slowing in 2025. Detailed hourly and daily engagement metrics provide unprecedented granularity, illuminating player behavior and enabling operators and affiliates to fine-tune strategies for maximum impact.

Success depends on understanding not just which games lead the market, but also when and how players engage. By leveraging insights, industry players can optimize live dealer resources, marketing efforts, and content strategies to meet evolving player demands.

As the live gaming market evolves, staying data-informed and agile is essential. Those who harness these insights effectively will set the pace for growth and innovation in the years ahead.

Most Recent News

Get the latest information