The Clone Effect: How Copycat Games Crowd Rankings but Fade Faster in 2025

In 2025, the iGaming content pipeline crossed a threshold. Across Europe, Asia, North America, and Latin America, operators are witnessing an unprecedented surge of clone titles—games that repackage the same mechanics, math models, and user experience skeletons, again and again. Our study, based on thousands of ranking positions collected from daily charts between August and November 2025, finally quantifies what many have suspected: copycat titles flood the rankings, but their lifespan is shrinking fast.

Out of 4,135 games tracked, 444 were clones, representing 10.7% of all titles. These games accounted for 11.5% of chart appearances, primarily driven by extensive launch promotion. But performance metrics reveal the opposite of longevity. Clones demonstrate lower endurance, averaging 1.57 appearances per title compared to 1.66 for originals. They achieve minimal cross-market travel, appearing in an average of just 1.09 countries. Despite aggressive early placement—with an average chart position of 3.16 versus 3.30 for originals—their advantage disappears within days.

In short, clones dominate visibility at launch, then drop off a cliff.

This article examines how this ecosystem evolved, what our data reveals, and why clones may be finally losing their competitive edge.

How Clone Design Took Over the Industry

Cloning has always been part of iGaming's DNA. For years, developers have iterated on “Book Of” mechanics, “Hold & Win” systems, Megaways structures, fishing-themed volatility, and mythology-based layouts. However, over the past two years, cloning has evolved from a routine process to an industrial-scale one. Studios now mass-produce variations that reuse existing math models, audio libraries, symbol sets, frame animations, user interface structures, bonus pacing, and hit frequency. This assembly-line workflow is efficient. The problem? It produces saturation, not longevity.

Furniture stores know how this ends: too much of the same product, and customers stop noticing the differences. In our dataset, this effect is most visible in families like Gold, with 130 titles, Book Of with 89 titles, Dragon with 80 titles, Hold & Win with 50 titles, Bonanza with 47 titles, and Gates/Glory with 22 titles. These families are no longer themes—they're ecosystems battling themselves. A new Gold-themed title has to compete with 129 siblings before it can compete with anything else. The result? Short bursts of visibility followed by rapid ranking decay.

What the Data Reveals About Clone Performance

Our analysis spans multiple dimensions of game performance, and every metric tells the same fundamental story: clones achieve short-term visibility through promotional investment but fail to sustain organic player engagement over time.

Oversaturation Is Concentrated in Key Families

A handful of heavy hitters dominate clone output. The standout groups—Gold, Book Of, Dragon, Hold & Win, Bonanza, and Gates/Glory—account for the overwhelming majority of cloned releases. This concentration reveals the industrial nature of modern cloning. These are not spontaneous convergent designs where multiple creators independently arrive at similar solutions. They are deliberate, systematic reproductions of proven formulas, manufactured at volume with minimal differentiation. The visual representation of this data shows a dramatic imbalance between family size and performance sustainability. The largest families generate the most titles but demonstrate the weakest per-game performance metrics.

Number of titles by clone family—Gold leads with 130 titles, followed by Book Of (89), Dragon (80), Hold & Win (50), Bonanza (47), Halloween (15), and Big Bass (11), compared against 3,687 standalone titles.

Clones Occupy More Space Than Their Size Suggests

Despite representing only 10.7% of total titles, clone games generate 11.5% of all chart appearances across our tracking period. This seven percent overrepresentation relative to their population share is entirely attributable to non-organic factors: early promotional boosts through operator marketing partnerships, preferential placement in lobby featured sections, and high-frequency release cycles designed to maintain constant visibility. These are business development tactics rather than organic performance indicators. The overrepresentation metric demonstrates that clone success depends almost entirely on external promotional support. When that support ends—as it inevitably must when the next batch of releases arrives—clone performance returns to baseline or below.

Market share distribution shows 444 clone titles (10.7% of the total) versus 3,687 original titles (89.3% of the total) out of 4,131 total titles tracked.

Initial Placement Outperforms Reality

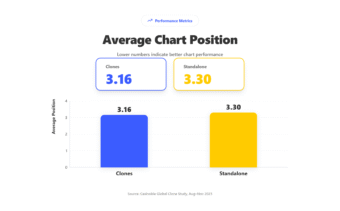

Average chart rankings show a slight overall advantage for clones, with an average position of 3.16 compared to 3.30 for originals. This is the promotional effect captured in its purest, most measurable form. Clones receive preferential top-line placement during their launch windows. Operators feature them prominently. Players see them first when they open game lobbies. The initial visibility advantage is real and quantifiable. But this advantage is entirely front-loaded and unsustainable. Once players begin interacting with these titles, organic engagement data starts influencing algorithmic rankings, and promotional budgets shift to the next release wave, the decline begins immediately and accelerates rapidly.

Performance metrics indicate that clones achieve an average position of 3.16, compared to standalone titles at 3.30—lower numbers indicate better chart performance, suggesting a promotional advantage for clones at launch.

Clones Decay Faster Than Original Titles

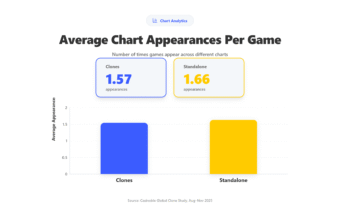

Chart longevity—measured as the average number of appearances per game over our tracking period—reveals the fundamental weakness of the clone strategy. Clone games average 1.57 chart appearances per title, compared to 1.66 appearances for original games. At first glance, this difference appears marginal, almost negligible. A gap of 0.09 appearances seems statistically minor. However, when multiplied across thousands of titles, hundreds of operators, dozens of markets, and daily ranking updates, this performance gap translates to massive aggregate differences in value creation and player engagement. It means that original titles deliver approximately six percent more sustained visibility per release. More importantly, the longevity gap reveals that clones fail the fundamental test of content value: they do not hold player attention over time. Players sample them, recognize them as variations of games they have already experienced, and move on. The message in the data is unambiguous: clones burn bright during promotional windows, then burn out rapidly once they must compete on actual gameplay merit.

Chart analytics reveal that clones average 1.57 appearances across different charts, while standalone titles average 1.66 appearances—demonstrating that clones’ weaker longevity persists despite their promotional advantages.

Minimal Cross-Market Reach

Clones average 1.09 countries per title, essentially identical to originals at 1.10, but with a critical distinction: clones rarely expand beyond their launch market. When a clone appears in 1.09 countries, it typically means the product launches in one primary market, receives limited testing in one secondary market, and is not distributed elsewhere. Original games that appear in 1.10 countries often follow a different pattern. They may launch more conservatively in fewer markets initially, but they demonstrate greater potential for genuine expansion when performance warrants it. This geographic sensitivity makes clones extremely vulnerable to short-term performance fluctuations. They lack the buffer that multi-market presence provides. If they fail to convert players during their launch window in their primary market, they vanish entirely from rankings.

How Players Are Reacting Across Markets

Our data shows surprising consistency across regional ecosystems. Despite differences in regulatory frameworks, cultural preferences, device usage patterns, and gaming maturity levels, players in Europe, Asia, North America, and Latin America are all demonstrating similar fatigue with clone content.

Europe: Mature Market Exhaustion

Players in mature European markets show the strongest fatigue. “Book Of” and “Gold” families see immediate declines after launch-day placement. Operators in Finland, Germany, Italy, Spain, the Netherlands, Norway, Romania, Sweden, and the UK report that clone titles fail to generate repeat sessions at the same rate as differentiated content. The data confirms that European players reward innovation and punish repetition more aggressively than any other region.

Asia: Mobile-First Does Not Mean Mechanic-Light

Fast-paced mobile-centric play should benefit clones, but the data shows the opposite. Asian players tend to respond better to mechanical innovations. Across India, Indonesia, Japan, South Korea, and other tracked markets, titles with hybrid features and adaptive volatility outperform clones by significant margins. The assumption that mobile players will accept any fast-loading familiar game has been proven false. Asian audiences are sophisticated, and they demand more than cosmetic variations.

North America: IP and Math Over Theme

Players in North American markets reward recognizable IP and bold math models. Novelty matters more than thematic repetition. Clone families like Dragon and Gold struggle to gain traction unless paired with licensed content or genuinely differentiated volatility profiles. Operators report that promotional spend on clones yields diminishing returns compared to investments in original titles with stronger brand identity.

Latin America: Volatility Fatigue

LatAm audiences typically convert well on simple mechanics and high volatility; however, even under these conditions, clones tend to underperform. Overproduced families, such as those represented by Gold and Dragon, experience a rapid decline after initial placement. Players in Brazil, Argentina, Mexico, and Chile demonstrate a clear preference for titles that combine familiar mechanics with fresh presentation or pacing adjustments. The region’s mobile-first audience has demonstrated that accessibility does not equate to tolerance for repetition.

What Players Want in 2025

Across all regions, the pattern is consistent. Players want differentiated math, cleaner interfaces, faster bonus pacing, less thematic repetition, and more variation in volatility. The data confirms that repetition no longer drives engagement. The industry’s reliance on cloning has outpaced player tolerance, and the consequences are now measurable in every major market.

How the Industry Is Responding

Studios and operators have not missed the signals. The clone boom is not ending overnight, but strategic adjustments are already underway across the content pipeline.

Reduced Clone Releases

Several studios are quietly reducing their clone output, focusing instead on quality-first, standalone designs. These studios recognize that flooding the market with variations cannibalizes their own catalog. By reducing volume and increasing differentiation, they aim to extend the commercial lifespan of each release and improve return on development investment.

Hybrid Themes Over Pure Clones

Developers are merging formulas, combining “Book Of” structures with new pacing or hybrid mythology themes. These hybrid designs aim to capture the familiarity that players recognize while introducing sufficient variation to avoid being immediately classified as clones. Early performance data suggest this approach extends chart presence by 20 to 30 percent compared to pure clones.

UX-Centric Mechanics

Meta-layer progression, adaptive volatility, and dynamic bonus cycles are gaining traction as clone fatigue rises. Studios that previously relied on thematic variation are now investing in mechanical innovation. Features like achievement systems, personalized bonus structures, and session-based progression provide differentiation that cannot be easily cloned, giving these titles longer competitive lifespans.

Operator Filtering

Operators are learning that cloning cannibalizes their own lobbies. When a lobby is filled with Gold variants, Book Of clones, and Dragon reskins, players experience decision paralysis rather than choice. Many operators have begun reducing clone clusters in “Featured” categories, preferring to showcase a smaller number of differentiated titles that drive higher engagement per impression. This shift in operator behavior represents one of the strongest market signals against continued clone production.

Localized Launch Strategies

Since clones don’t travel well, some studios are pivoting to market-specific releases rather than global multi-country drops. By designing games with regional preferences in mind from the start—whether that means specific math profiles, cultural themes, or mobile optimization priorities—these studios achieve higher conversion rates and longer retention in their target markets. The strategy trades breadth for depth, and early results suggest it delivers better overall returns than a wide, but shallow, clone distribution.

The industry is slowly rebalancing, shifting its focus from quantity to differentiation. The economics of cloning remain attractive in the short term, but the performance data are forcing a reckoning.

What Comes Next for 2026 and Beyond

The clone boom won’t disappear completely. The production economics are too convenient, and the infrastructure for rapid replication is now embedded across the industry. But its dominance is fading, and our study makes that trajectory clear.

Risks Ahead

Studios that continue to rely on clone production face accelerating cannibalization, lower conversion rates, player burnout, weak market expansion, and promotional inefficiency. Each new clone reduces the effectiveness of every previous release in the same family. As players become more adept at instantly recognizing clones, promotional windows will continue to shrink further. Operators will continue to reduce the lobby space allocated to clone clusters. The risk is not that cloning will become impossible, but that it will become commercially irrelevant.

Opportunities Emerging

The decline of clone dominance creates space for innovation to reemerge. Feature-light, high-replay mechanics that prioritize session quality over thematic variation are gaining traction. More volatile standalone systems that offer differentiated risk-reward profiles attract players seeking fresh experiences. A region-first design that prioritizes cultural fit over global scalability yields stronger returns per market. Better meta-layering that adds progression systems and achievement structures extends player engagement. Original math models, built for cross-market travel rather than copied from existing templates, demonstrate stronger longevity and geographic reach.

The next wave of successful content won’t rely on outdated systems. It will refine them. Innovators will outperform duplicators. Studios that treat familiarity as a foundation rather than a shortcut will capture disproportionate value as the clone saturation effect intensifies.

Conclusion

The Clone Effect is not an anecdote. It is the measurable reality of 2025. With 444 clone titles tracked, weaker longevity metrics, minimal cross-market travel, and faster decay rates, the high-output cloning strategy is losing its commercial viability. Players are showing fatigue across every major region. Operators see diminishing returns and are actively filtering clone content from premium placements. Studios are adapting their development pipelines to prioritize differentiation over volume.

The future belongs to developers who use familiarity as a foundation, not a shortcut. Originality didn’t go out of style—it simply got buried under thousands of copies. Now, the data is pulling it back to the surface. Read our other blogs at Casinoble for more articles like this.

Methodology

This study is based on proprietary iGaming Tracker data collected between August and November 2025, covering daily chart positions across Europe, Asia, North America, and Latin America. The dataset includes 4,135 unique games, with 444 identified as clones based on shared mechanics, math models, and UX structures. Analysis focused on chart longevity, cross-market reach, average positioning, and regional performance patterns to quantify the competitive impact of clone saturation.

Most Recent News

Get the latest information